Your state s plan best 529 plans of 2020 compare 529 plans complete guide to 529 plans enroll in a 529 plan top 10 performance rankings 5 cap ratings 529 plan investment options 529 fee study 529 able accounts find a 529 pro newsletters 529 news.

Compare 529 plans side by side.

Pro subscribers can select up to 6.

You may select up to 2 plans at one time.

Many 529 savings plans feature vanguard funds and or investment management.

May be waived for maine residents eligible for.

You can select as many state 529 plans as you wish to compare.

Powered by wealth management systems inc.

Listed below are the states that offer a 529 plan s.

529 plans are a type of tax advantaged investment account that is widely considered one of the best ways to save for college.

Always consider your home state plan as it may offer state tax or other benefits for residents.

Select a vanguard associated plan.

Some states may offer more than one plan.

Select up to two 529 plans to compare.

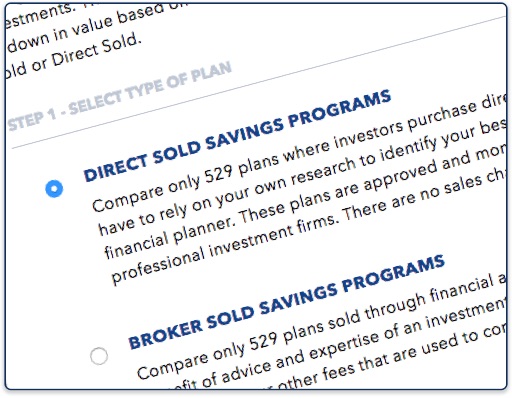

Compare 529 college savings plans.

Withdrawals from a 529 plan for qualified expenses are free from federal income tax.

With lump sum contributions the minimum initial contribution is 25.

Does the sponsoring state exclude the value of an account for state financial aid purposes.

Select the plans you would like to compare and click compare.

Select the 529 state plans you wish to compare.

I ve been doing some research into college savings plans and here is a side by side comparison of the coverdell education savings account esa and the 529 college savings plan.

Accepts contributions until all account balances in 529 plans for the same beneficiary reach 500 000.

When the tax cuts and jobs act was implemented it changed the rules around 529 plans.

You can now also use the distributions for elementary and secondary k 12 public private or religious schools up to 10 000 per year.

The coverdell used to be known as an education ira and still functions similar to a roth ira for qualified educational expenses.

The plan is issued by the south dakota higher education savings trust.